| |

|

|

Welcome To R M RAO & Associates

R M RAO & Associates is an audit firm started by CA Mallikharjuna Rao Ramu (Founder) in Sep '2015, to provide and deliver best practices to the clients in the areas of Internal Audit, Statutory Audit, Taxation and various advisory functions and also to stand-in the values of the clients business in terms of integrity, credibility and transparency.

Firm's Registration Number - (FRN): 016362S

Our Values, Goals and Methodology

Building trust and relationship is utmost in all our actions. We firmly believe that integrity has no substitute. We are constantly in pursuit of par excellence. To be the frontrunners in our field is a burning desire. Every assignment at our firm is under the direct charge of a senior Qualified Accountant, whose responsibility is to be a mentor, guide and supervisor to the engagement team.

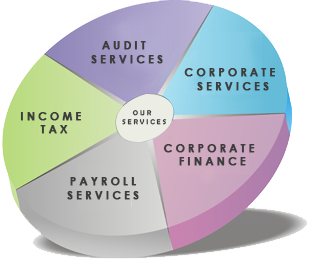

Service Areas

AUDIT SERVICES

Indepth study of existing systems, procedures and controls for proper understanding.

Read More >

CORPORATE SERVICES

Planning for Mergers, Acquisitions, De-mergers, and Corporate re-organizations.

Incorporation of company

Read More >

CORPORATE FINANCE

Private placement of shares, Inter-Corporate Deposit, Terms loans, working capital limits, etc.

Read More >

ACCOUNTING SERVICES

Accounting System Design & Implementation

Financial Accounting

Read More >

GST

The Goods And Services Tax (Compensation To States) Bill, 2017

FAQ on GST (second Edition)

Read More >

PAYROLL

Deductions as per applicable laws like Income Tax, Provident Fund, Professional Tax etc.

Read More >

|

|

|

|